Panama: So What Now?

Like others in several countries, on Monday April 4, Indians added a new word to their lexicon ‘Panama Papers’.

For the sliver of population who missed out on this thunderbolt, here is a quick recap. Panama Papers is an investigation published by the International Consortium of Investigative Journalists and its media partners(Indian Express in India 2) reveals the hidden workings of a secretive banking industry that lawyers and accountants use to hide the financial holdings and dealings of powerful clients.The list includes prime ministers, parliamentarians, plutocrats and criminals.(1) T

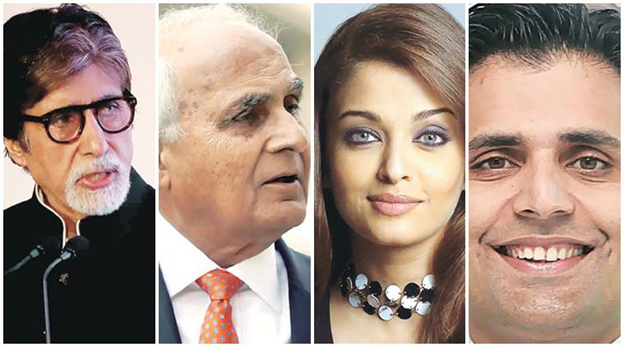

he documents reveal names from as diverse sources as Iceland Prime Minister, Vladimir Putin along with his arch rival Ukrainian president Petro Poroschenko, Chinese politburo members to Football celebrity. Close to home Indian Brand Ambassador Amitabh Bachchan giving company to Iqbal Mirchi the underworld don and senior of the omnipresent businessman Adani.

The response from the Indian establishment was as expected. Most of the media reported in as toned down manner as possible lest they fall out of line. PM ticked the box by welcoming the information and instituting an enquiry. Government was prompt to point out that “not all offshore dealings are illegal. Companies or trusts can be set up in low tax places like Panama for legitimate uses such as business finance, mergers and acquisitions and estate or tax planning.”(3)

Average persons may think and it is not far off the dart board, that offshore banking is that hideous secretive underbelly of Global finance frequented only by shady arms or drug dealers, criminals and Mafiosi. Hardly anyone ever thought that such cultured and charismatic persons adored by millions would betray their trust and devastate the systematically cultivated picture perfect image.

But, then there are apologists who argue that use offshore banking is also a tax planning strategy. Given the competing tax regimes, capital will flow to optimize returns and encourage saving and investment. The deeds of these galaxy of wise selfless individuals follows sound economic logic. Let us not get sentimental about it. Rather whether to call India, Bharat or Bharat-mata is a more substantive issue. Let’s focus on it.

However, it is interesting to note here that, globally the issues related to Tax Planning and Tax Evasion have crossed the semantic boundaries and the matter has seized the attention of the ruling elite as well as civic society. With increasing neoliberal compulsions of balancing budgets while meeting the social welfare obligations already squeezed to its explosive minimum , the political leadership has started making a noise about tax planning and tax avoidance.

In one of the recent G8 summit of world leaders, David Cameron’s speech had tax as a key theme. His emphasis was not only on tax evasion – by definition illegal behavior – but also “aggressive tax avoidance”; term made popular by his chancellor of exchequer George Osborne in his budget speech in parliament.(4)

In fact this development of tax havens as means for official tax planning has long been recognized as sinister fallout of Globalization. Way back in G7 Lyon summit of world leaders in 1996, Tax policy was identified as a problematic area. According to the summit communiqué: (5)

“Globalization is creating new challenges in the field of tax policy. Tax schemes aimed at attracting financial and other geographically mobile activities can create harmful tax competition between states, carrying risks of distorting trade and investment and could lead to the erosion of national tax bases.”

However, it will be naïve to get carried away by this moral grandstanding which global elite does at every conceivable opportunity primarily for public consumption. Today, there is a unique convergence of politicians, bankers, media barons, industrialists, celebrities and drug/crime syndicate bosses. It is most unlikely that any one of them will ever dream of a fratricidal move that will upset the apple cart.

Coming back to the Bachchans and the Adanis. In a country like India, where the rule of law is hanging on a tenuous link, expecting any institutional solution is utopian. Instead we may have to depend on the morality dimension, and more aggressive a name and shame game. Let us ask these dignitaries and leaders of society, how in the first place, they live with existential dichotomy of on one hand their own overflowing affluence far in excess of what they can consume and poverty, malnourishment and deep agrarian distress. How do they live out the falsehood of delivering a poetic discourse on this transient worldly existence in their mellifluous voices, shortly after getting a confirmation that their millions have reached the destination safely all intact. Or has the system eviscerated them of all humanity and all that is left is an empty box?. After all, the value of a person is the values he lives.

1. https://www.publicintegrity.org/2016/04/03/19503/massive-leak-reveals-offshore-accounts-world-leaders

2. https://www.icij.org/journalists/ritu sarin#_ga=1.192147562.1591495964.1459838908

3. http://www.ndtv.com/cheat-sheet/in-panama-papers-500-indians-including-actors-industrialists-10-facts-1333660

4. https://www.fundstrategy.co.uk/the-moral-offensive-against-tax-avoidance/

5. https://www.fundstrategy.co.uk/the-moral-offensive-against-tax-avoidance/