Crony Capitalism Thrives in India, 9th in World Index

MUMBAI: Corporate titans in India and around the world two years ago celebrated the victory of Narendra Modi’s government in 2014 elections. In a country where radical leftists still exert a mighty influence in some states and on the intellectual centre of gravity, Modi’s platform is unapologetically pro-business. However, to make India friendlier to the free market, PM Modi has had to step on the toes of those business leaders who backed him. The opposition has been criticising the Modi government for favouring crony-capitalism in the country. However, crony-capitalism is not a new phenomenon in the global market.

According to a study carried out by The Economist recently, India is ranked at 9th position in crony-capitalism with crony sector wealth accounting for 3.4 per cent of the gross domestic product (GDP) against 18 per cent in 2008, when cronyism was at its peak internationally. In India, the non-crony sector wealth amounts to 8.3 per cent of the GDP, as per the latest crony-capitalism index.

India, coming in the ninth place, now compares with Australia, instead of competing with Russia eight years ago, which is at the top of the list now. It is one ranking where the government would not like to complain about scoring less.

What is crony capitalism? Crony capitalism is a term used for an economy in which success in business depends on close relationships between business people and government officials. It may be exhibited by favouritism in the distribution of legal permits, government grants, special tax breaks, or other forms of state interventionism.

Crony capitalism is believed to arise when business cronyism and related self serving behaviour by businesses or business people spills over into politics and government, or when self-serving friendships and family ties between businessmen and the government influence the economy and society to the extent that it corrupts public-serving economic and political ideals. In this context, the term is often used interchangeably with corporate welfare; to the extent that there is a difference, it may be the extent to which a government action can be said to benefit individuals rather than entire industry.

In 2014 ranking also, India stood at the 9th place. Using data from a list of the world's billionaires and their worth published by Forbes, each individual is labelled as crony or not based on the source of their wealth.

Russia tops the list of crony capitalists followed by Malaysia, the Philippines and Singapore. Russia fares worst in the index, as wealth from the country's crony sectors amounts to 18 per cent of its GDP. Germany is the cleanest in the world, with just a few of the country's billionaires deriving their wealth from crony sectors.

"Thanks to tumbling energy and commodity prices politically connected tycoons have been feeling the squeeze in recent years," the study said.

Among the 22 economies in the index, crony wealth has fallen by $116 billion since 2014.

"But as things stand, if commodity prices rebound, crony capitalists wealth is sure to rise again". The past 20 years have been a golden age for crony capitalists—tycoons active in industries where chumminess with government is part of the game. One reason is the commodity crash. Another is a backlash from the middle class".

Worldwide, the worth of billionaires in crony industries soared by 385 percent between 2004 and 2014 to $2 trillion.

Whether it is Xi Jinping’s "crackdown against corruption" in China or Prime Minister Narendra Modi "trying to subject the economy to a blast of competition", governments are initiating a cleanup everywhere, says The Economist. It also cites pressure from the middle class, reflected in the election of Arvind Kejriwal in Delhi. Actually, Kejriwal has been able to bring down corruption in the Delhi government resulting in the steady fall of crony wealth in the country.

The fall in commodity prices, weak currency and stocks in emerging markets and the end of the property boom in Asia seem to have led to a global reduction in crony wealth, says The Economist.

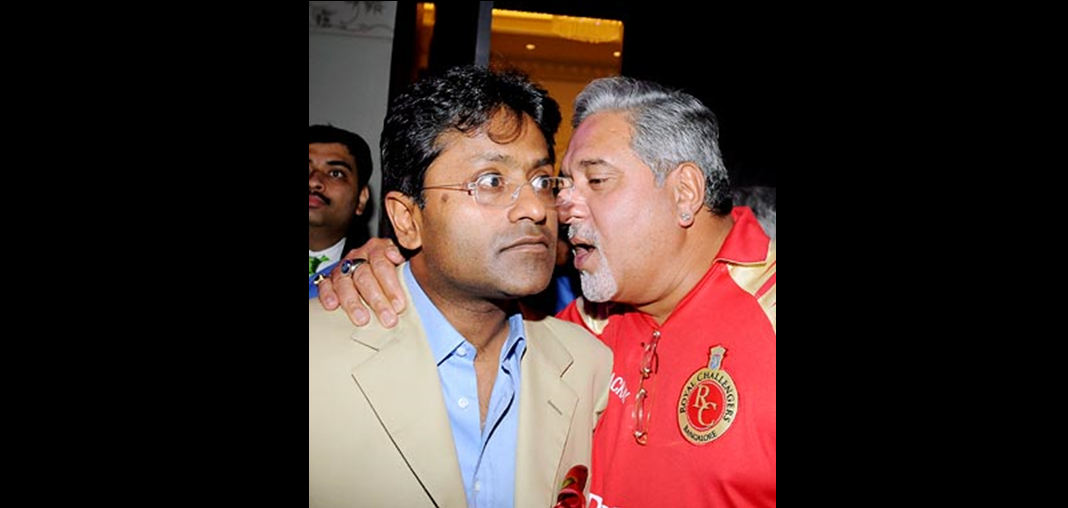

The magazine quotes the example of liquor baron Vijay Mallya's "fight against deportation to India" to the arrest of a construction company's executives in Brazil in a corruption scandal involving Petrobras, the state-owned oil company, to illustrate how pressure is mounting on those who benefited from the opaque ways in which the state functioned.

Referring to India, the Economist said, "A slump in commodity prices has obliterated the balance sheets of its Wild West mining tycoons. The government has got tough on graft, and the central bank has prodded state-owned lenders to stop giving sweetheart deals to moguls. The pin-ups of Indian capitalism are no longer the pampered scions of its business dynasties, but the hungry founders of Flipkart, an e-commerce firm."

While the Modi government has initiated several steps to bring about transparency, including auction of telecom spectrum and mining rights, the Economist warned that the gains could be tough to sustain. To begin with, the wealth of crony capitalists could rise as commodity prices rise.

Globally, crony billionaire wealth was estimated at $1.75 trillion, 16 per cent lower than the estimate in 2014. The fall is led by emerging markets, where its share in GDP has decreased from 7 per cent to 4 per cent. "The mix of wealth has been shifting away from crony industries and towards cleaner sectors, such as consumer goods," the magazine said.

After all, as we have known since Adam Smith, what is in the best interests of business is not always the same as what is in the best interests of the individual — and “business friendly” is not the same as “market friendly.” Nor should PM Modi or his economic advisers hold themselves captive to the vagaries of the day-to-day fluctuations of the markets, which scream from the headlines of business publications. Rather, it is on the big picture — reforming the country’s economic and financial architecture — that PM Modi and his team should stay firmly focused to move forward by curbing crony capitalism.

(The writer is a retired Senior Professor ‘International Trade’)