Demonetization: Monetary Anemia Needs Transfusion Not Jumla's

NEW DELHI: We are now well into the third week of yet another “surgical strike” (as it was described by Amit Shah) by Prime Ministers magic wand attempt to cleanse the national economy of “black money” by demonetizing the two high value currency notes. But demonetization of the Rs.500 and Rs.1000 notes the government sucked out almost 87% of the money in the market.

When the Prime Minister announced this demonetization to rid the nation of “black money”, which really means income and financial transactions that didn’t realize for the state its rightful share of taxes, the entire nation welcomed it. The other reasons the government gave for this is that it wanted the purge the system of counterfeit notes and breakup the terror finance network.

There is indeed a problem with counterfeits. In 2014-15 they rose by 22% to almost 6 lakh pieces. In 2015-16 of the counterfeits detected, 41% were in 500’s, 35% in 100’s and the rest in 1000’s. Of the 90.26 billion Indian currency notes in circulation in 2015-16 , no more than 0.63 million– that is 0.0007%, or seven-millionths of 1%, seven in every million – were detected as fake, according to the RBI. The value of these fake notes in 2015-16 was Rs 29.64 crore, which is 0.0018% of the Rs 16.41 lakh crore currency in circulation. These are notes in flow, and assume that several times more are flowing undetected or sitting in dormant stock. This is still relatively small change, not distorting the system by much. A better way could have been found to filter them out by an orderly exchange of high value notes. Special exchange counters in bigger bank branches with high volume counterfeit scanners cum counting machines, without impeding regular banking services. Instead we induced chaos and brought the system to a near standstill.

With the benefit of cold hindsight, and with the comfort of not having to go against the now clearly waning popular sentiment for demonetization, it’s very evident that the government was clearly unprepared to embark upon such a major “reform.”

The nation has now experienced the breakdown of the financial system and the severe pain it has inflicted on the hundreds of millions who sustain themselves as daily wage earners, small retailers of perishable goods and farmers who have to invest now to sow fresh crops and reap harvests of food grains and fruits and vegetables.

Consequently the nation has belabored the Prime Minister severely and the Prime Minister, proud of his broad chest, has been reduced to tears twice in the past fortnight.

What went wrong? The first is very obvious. It should have had enough of the new money for transfusion to replace the withdrawn lifeblood. It also did not build up meaningful stocks of the existing Rs.100 and smaller denomination notes to make everyday transactions happen without so much dislocation. That was not the case. It is now clear that the RBI will take many months just to replace the high value notes. Till then the anemia will persist.

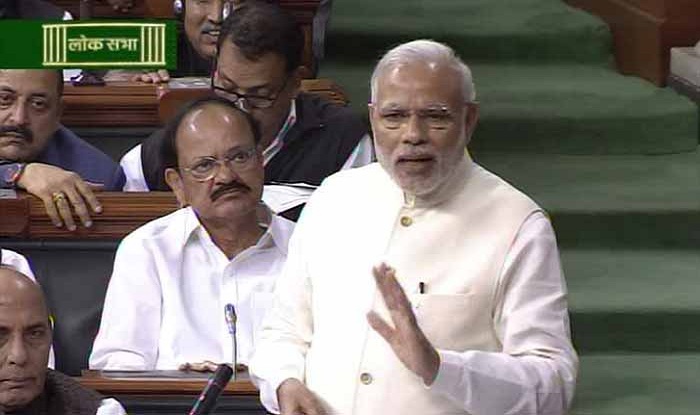

There is bound to be economic costs for this prolonged anemia. The former Prime Minister Dr. Manmohan Singh, less of a politician and more of a top-notch economist, speaking in the Rajya Sabha estimated the consequential contraction of GDP to be about 2%. I was in a discussion with several senior and serious economists and the most conservative estimate was a drop in GDP by at least 2.2%. That kind of sudden contraction, at about the halfway point of the financial year, will mean that the immediate contraction is going to be much more painful.

Consider this. Almost 40% of the GDP is in cash transactions. As much as 31% of adults do not have bank accounts. The Jan Dhan drive has indeed substantially added to the number of bank accounts. But nearly half of the additional bank accounts are “zero balance” accounts. Creative optical solutions being this government’s forte, all these accounts have now been credited with Rs.1 each to take them out of this column.

With this looming contraction in the immediate future, one would not be surprised if the government will once again resort to creative optical solutions by “improving” national income accounting by putting new values to unrecorded production and services. For instance by re-estimating the value of chappals made by village cobblers or the value addition of panwallahs. But then don’t compare it with earlier growth rates. The last such tweak gave this regime an additional 2.2% GDP boost, but was misused by it to suggest the train was moving faster.

Now look at the scale of damage caused. India has a work force of close to 450 million. Of these only 7% are in the organized sector. Out of these 31 million about 24 million are employed by the state or state owned enterprises, the rest being in private sector employment. Of this vast reservoir of over 415 million employed in the unorganized sector about half are engaged in the farm sector, another 10% each in construction, small-scale manufacture and retail. These are mostly daily wageworkers and mostly earning less than the officially decreed minimum wages. Thus, a good part of this so-called “black money” held in Rs.500 and Rs.1000 notes the government has choked off is actually good money in flow. What the government is seeking to unearth is a smaller part of the money in stock, which is held by businesspeople, politicians and bureaucrats.

But in its professed anxiety to unearth this the government has effectively thrown out the baby with the bathwater. The economy may not have ground to a complete halt, but in hundreds of million homes the cooking fires are not being lit. This is because most daily wage earners are not getting paid in full or even in part. And even if they are paid with the old notes, and even if they can enter banks, where are the smaller notes or even new notes for the banks to exchange them with?

The amount of “black money” held as cash is only about 5% of the total tax evaded income. The rest is held in cash abroad, land and property, and jewellery and gold. Unearthing this will take some doing and in doing so the officialdom and its political masters will only generate more “black money.” And consider this as much as 55% of the FDI investment coming in (about $44 billon last year) is actually Indian owned money round tripping its way back from the economy it fled from. Is the government now going the look at this gift horse in the mouth, by asking these ECB’s to declare their origins?

So after not anticipating the scope of the economic devastation visiting the nation, the Prime Minister has taken a new tack. He is now hollering that he is fighting for the vast mass of the poor who have been looted all these decades by the upper classes. He has thus demonized the upper classes and has fired the starting gun for class warfare that would have made Lenin and Mao proud. He is even started saying startling things like “mere jaan ko khatra hai” because of his newly donned mantle of the class warrior. His claim of death threats to him supposedly due to this has generated much consequential mirth in the social media with a play on the word “jaan.”

Till now Narendra Modi has been largely immune from this. He enjoyed huge support, even without the bot armies and professional social media manipulators, while he has also been hugely vilified. But of late he has become a cause of mirth. With that he has entered politically dangerous waters.

Will the Prime Minister now retrace his steps somewhat and extend the deadline for the exchange of high value notes? Will be now order the massive build up of Rs.100 and smaller notes to relieve the monetary anemia? This will no doubt involve some loss of face. But that is still better than loss of head.