Could India Become the World's Biggest Name in the Mobile Sector?

India’s position as a tech giant could help improve its global standing.

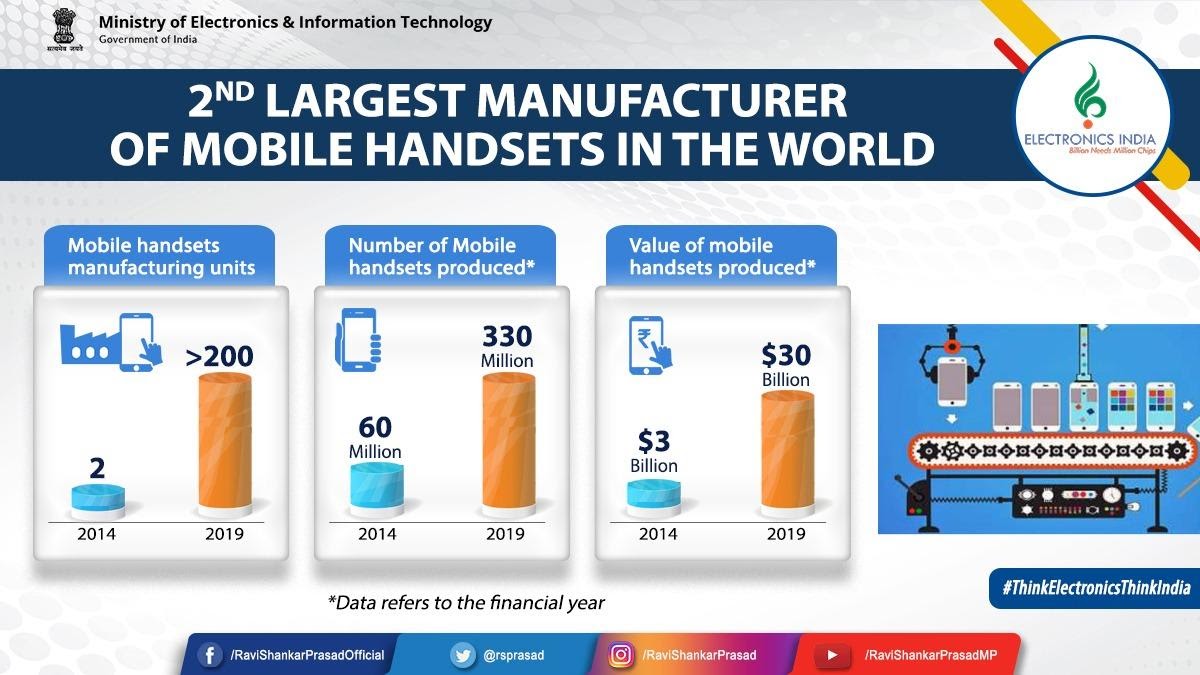

Electronics and Information Technology Minister Ravi Shankar Prasad has suggested that India has now become the second-largest mobile phone manufacturer. Up to the close of financial year 2020, India exported 36 million units of mobile phones, compared to the 17 million at the same time in 2019. India is angling for the top spot by enhancing its ability to create and export more smartphones and to provide and endorse mobile payment services, strengthening the industry. Could India become the world’s biggest name in mobile?

TWITTER: India has emerged as the 2nd largest mobile phone manufacturer in the world. In the last 5 years, more than 200 Mobile Phone Manufacturing units have been set up.

India is Smart on Smartphones

While there were just two mobile phone manufacturing operations in the country in 2014, 2020 has seen more than 200, which explains the huge increase in exporting the devices. Similarly, while 2014 brought in $3 billion from exporting phones, 2020 has increased this tenfold. This is important on a global scale, especially as India is pivoting to become the next largest electronics hub. The increased figures and manufacturers in the country show that it is possible to increase their standing and become the global name in smartphones.

Indeed, smartphones are not only a way of life for citizens in India, but are increasingly being used in a more official capacity, as the electioneering conducted over social media in Karnataka showed. More importantly, the use and ownership of smartphones reflects people’s standing and their place in the fluctuating economy. Indeed, 2019 saw a sharp decline of mobile subscribers, especially in rural areas. Smartphones in India don’t just contribute to the economy, they help to reflect how well it is doing.

Centre launches schemes to boost electronic manufacturing - TWITTER

Mobile Payment Industry Booms in India

The mobile payments industry in India is also growing. This comes as a direct result of the growth of the smartphone sector and the accessibility of these phones – even in remote villages, people have mobile phones. KPMG suggested that mobile payments in India will grow 20% by 2023 and will eclipse those of China, who have wholeheartedly adopted the technology.

Even small stores and street vendors are able to accept mobile payments and have a host of QR codes to help make this possible. While only 10-15% of retail transactions are mobile, this figure is expected to grow. The penetration of mobile payments in India only adds further proof that the country is ready to take on the mantle of helping the rest of the world with its mobile capabilities. By showing that its own citizens use the services, India is its own best case study for its electronics progress.

One of the biggest coups for the mobile payments industry in India is the ability for those without smartphones to make payments through mobile means. The National Payments Corporation of India, responsible for Unified Payments Interface (UPI), created the *99# service, which allows people to interact with digital wallets without internet connectivity or an advanced smartphone. This technology hasn’t been adopted as much as the NPCI would like, especially compared to similar schemes in Kenya.

What Does the Global Mobile Payment Industry Look Like?

Mobile payments and alternative forms of finance are growing in popularity around the world and in many different industries. This reliance on mobile payments helps further add legitimacy to a growing mobile sector. E-wallet and mobile payment method Skrill has a range of uses in industries as varied as Ethiopian Airlines and Skype – reflecting the nature of those who might want to use the brand. Ethiopia has a flourishing mobile payment industry, while Skype is used around the world, in areas where mobile payments thrive.

The entertainment sector is also allowing forms of payment methods that exist on digital and mobile platforms. Betway Casino accepts e-wallet deposits for their casino games allowing players to use Skrill and Neteller to engage with the latest slot and live table game titles. While the Microsoft store accepts mobile payments, having retired their Microsoft wallet in 2019. Moreover, homemade goods site Etsy allows a range of mobile payment options, including Google Pay and even more advanced e-wallets, with the option being at the discretion of the individual vendor.

In the battle for dominance on the global electronics scale, many factors are working together to help India edge towards the lead. Not only has production in the country amped up, but success in the field is giving greater legitimacy to India’s claim to the title. Moreover, a move away from the traditional electronics leaders in China are allowing India to show their worth in the field. The rise in mobile payments on a global scale means that there is increased appetite to pave forward with the technology, which leaves India in a prime position to take ownership. Growing technology will be important for all countries on the global stage, especially when considering trade partnerships with one another. India’s position as a tech giant could help improve its global standing.