Demonetisation: Unable to Cope, the Government Rapidly Moves Goal Posts

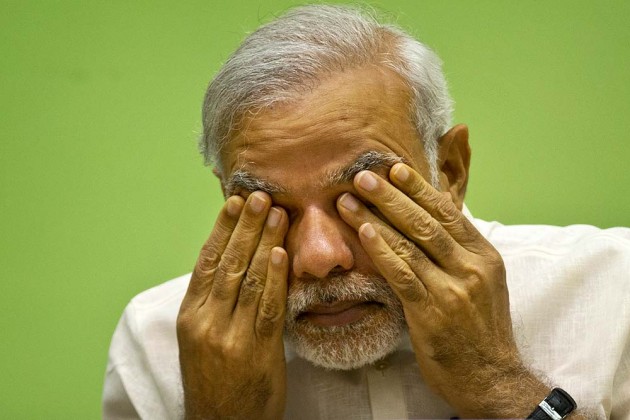

NEW DELHI: In the weeks that have followed Prime Minister Narendra Modi’s surprise announcement to demonetise 500 and 1000 rupee notes on November 8, the rules governing the move have repeatedly changed.

As the queues keep getting longer and reports of distress come pouring in, with over 70 people having lost their lives in demonetisation-related deaths since the announcement, the government has responded to the crisis by putting in place a set of confusing measures, that are haphazardly extended or scrapped.

The original cap of of Rs. 4000 on exchange of old notes -- which was to be reviewed after 15 days -- was first raised to Rs. 4500, but as the queues kept getting longer, the government decided to use indelible ink to prevent people from making multiple exchanges, inviting a measure of protest from the election commission in the process. Unable to curb the queues, the government quickly cut the note exchange limits to Rs. 2000 from 4500, just a day after select banks began using the ink.

While many defend demonetisation of the higher value notes, saying that a few weeks of uncertainty is to be expected, criticism relating to the lack of organisation and preparedness is quickly mounting, with the government being faced with an Opposition almost unanimous in its criticism of the move. This lack of preparedness and organisation is evident in the abrupt changes to policy.

On November 17, almost 10 days after 500 and 1000 rupee notes were demonetised, a new measure in the relaxation in cash withdrawal limit for weddings was to come into effect. However, owing to the lack of operational rules, both public and private sector banks cited non-issuance of operational guidelines from the central bank as the reason for being unable to disburse the new permitted amount of cash upto Rs. 2.5 lakhs to families of brides and grooms. It took an additional four days for the operational guidelines to be issued.

Similarly, on November 21, weeks after the original announcement, the government moved to allow farmers to purchase seeds for Rabi crops using old Rs 500 notes from government outlets or the state / central agriculture university. The fact that it took almost two weeks for such a measure to be introduced is indicative of the lack of preparedness on the part of the government.

A timeline of the original policy and subsequent changes is as follows:

November 8

- On November 8, Prime Minister Modi announced that all 500 and 1000 rupee notes would cease to be legal tender from midnight.

- A limit of Rs. 10,000 per day and Rs. 24,000 per week was imposed on withdrawls from bank accounts.

- Deposits into accounts were to have no limits.

- Withdrawals from ATMs were capped at Rs. 2000/day (to be doubled from Nov 19)

- An exemption was included for utility bill payments, purchase of air, rail and metro tickets, payments at petrol pumps and government hospitals - initially for a period of three days.

- It was announced that banks would be shut on November 9, and ATMs would not be operational November 9-10.

November 11

- The exemptions on utilities, air/rail/metro tickets, petrol pumps and government hospital payments were extended till November 14.

November 13

- The limit on exchange of old notes was extended to Rs. 4,500

- The daily cap on cash withdrawals was removed, with a weekly cap of Rs. 24,000 in place.

- A maximum of Rs. 2500 a day was placed on withdrawals from ATMs.

November 14:

- An earlier deadline for old notes in some sectors, namely utilities, air/rail/metro tickets, petrol pumps and government hospital payments was extended till November 24.

- Current account holders were allowed to withdraw upto Rs. 50,000 per week.

November 15:

- A cap of Rs. 50,000 was placed on deposits into Jan Dhan accounts.

- Announcement instructing banks to use indelible ink was issued.

November 16:

- Select bank branches began using indelible ink, after the announcement instructing them to do so was issued on November 15.

November 17:

- The government slashed the onetime exchange limit for old notes to Rs 2000 from Rs 4500, having raised it from Rs 4000 before that.

- The weekly withdrawal limit for savings bank account users was raised to Rs 24,000 from Rs 20,000 with the limit of Rs 10,000 per day being scrapped.

- For farmers who have taken a crop loan or have kisan credit cards, a special provision was introduced allowing them to withdraw Rs. 25,000 per week. For farmers receiving kharif payments by cheque or RTGS, a withdrawal limit was placed at Rs. 25,000 per week.

- Families were allowed to withdraw Rs. 2.5 lakh for marriages, however, this was not implemented, as public sector and private banks cited non-issuance of operational guidelines from the central bank for being unable to disburse the newly permitted amount.

November 21

- The government’s announced that farmers will be allowed to purchase seeds for the Rabi crops using old Rs 500 notes from government outlets or state, central agriculture university.

- Four days after the withdrawal on marriage exemptions were to come into effect, the RBI issued norms on the provision. A wedding card, copies of advance payments made for booking marriage halls and caterers will be required for withdrawing Rs 2.5 lakh from accounts for marriage purposes, the RBI said. Withdrawals will be allowed only from balance available before November 8, and the same can be done only for marriages solemnised on or before December 30.

November 24

- Exemptions for utilities, air/rail/metro tickets, petrol pumps and government hospital payments came to an end midnight November 24.

In addition to the official guidelines -- that have changed repeatedly, the chaos is evident in the fact that bank branches all have their own rules for dispensing withdrawals, deposits and exchanges. “Even after the government said we can withdraw Rs. 50,000, banks are refusing to do so citing shortage of funds,” a Delhi-based entrepreneur told The Citizen.

A bank manager at an HDFC branch in the capital admitted to The Citizen that the branch had received no money on one particular day, and was thus unable to dispense any amount. “We’re told the money has been sent to rural areas,” the manager admitted. At another HDFC branch also in New Delhi, the manager told The Citizen “only Rs. 2 lakhs has come in today.”